Incentives & Financing

Are you looking to start a new business or expand your current operations in our community and would like to know if we can help? Click here to tell us about your project, and we will reach out to you!

Local Incentives

Creekside Subdivision Builder Incentive

Lots within the Creekside Subdivision will be available for sale to home builders.

Creekside Subdivision Builder Incentive Guidelines

Facade Improvement Grant

If you own a commercial or non-profit building located in the 9-block Downtown District and on the main corridors (Broadway, Elm, Hailey, and Lamar Streets) in Sweetwater, then you are eligible to apply for a Facade Improvement Grant. SEED MDD is willing to reimburse half of the expenses up to $15,000.00 (the owner would need to spend $30,000.00 to receive the full $15,000.00) to those that would like to improve the appearance of their building and help beautify our community.

View the application: Facade Improvement Grant Master Copy

Nolan County Tax Abatement Guideline

A uniform policy of tax abatement for owners or lessees of eligible facilities willing to execute tax abatement contracts designed to provide long-term significant positive economic impact to Nolan County by utilizing the area contractors and workforce to the maximum extent feasible, and by developing, redeveloping, and improving the property.

View the Nolan County Tax Abatement Guidelines

RPMH Tax Abatement 2021

A uniform policy of tax abatement for owners or lessees of eligible facilities willing to execute tax abatement contracts designed to provide long-term significant positive economic impact to Nolan County by utilizing the area contractors and workforce to the maximum extent feasible, and by developing, redeveloping, and improving the property.

View the RPMH Tax Abatement Guidelines.

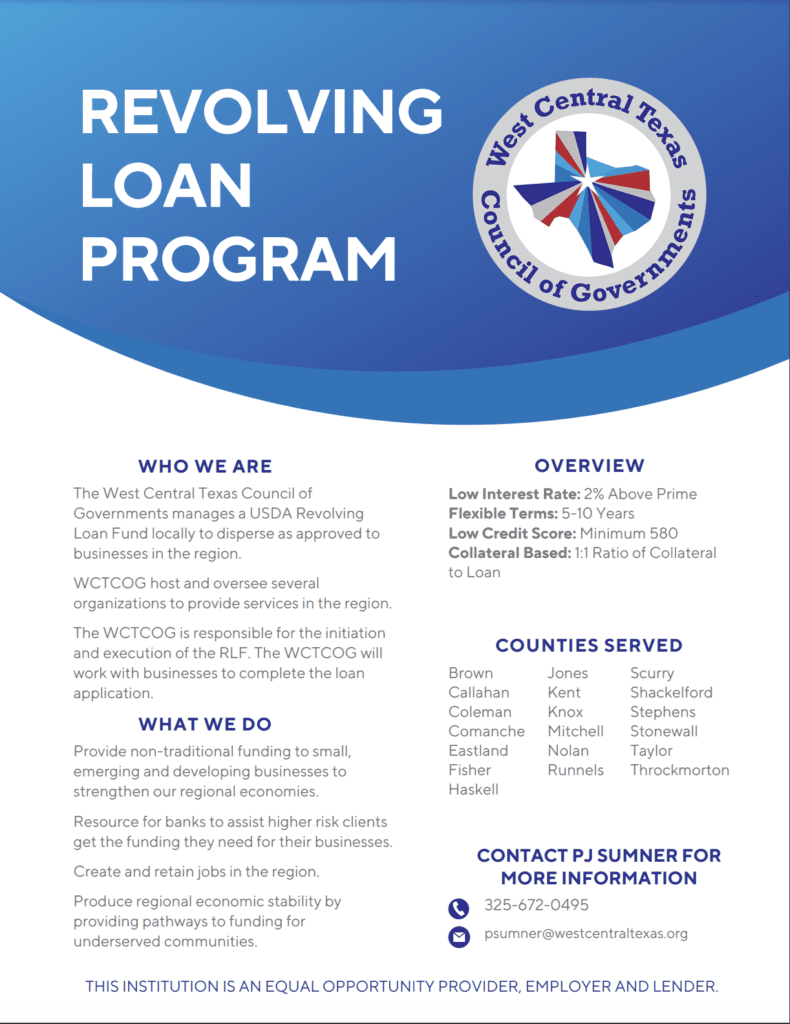

West Central Texas Council of Governments

State Incentives

Office of the Governor Incentive Programs

- Texas Enterprise Fund

The Texas Enterprise Fund (TEF) is the largest “deal-closing” fund of its kind in the nation. The fund is used as a performance-based financial incentive tool for projects that offer significant projected job creation and capital investment and where a single Texas site is competing with another viable out-of-state option. - Events Trust Fund

The Events Trust Fund program applies local and state gains from sales and use, auto rental, hotel, and alcoholic beverage taxes generated over a specified period of time. Eligible events are not restricted to sports, but the venue must have been selected through a highly competitive selection process. - Governor’s University Research Initiative

The Governor’s University Research Initiative grant program (GURI) has a goal to bring the best and brightest researchers in the world to the State of Texas. This program is a matching grant program to assist eligible institutions of higher education in recruiting distinguished researchers. - Texas Enterprise Zone Program

The Texas Enterprise Zone Program is an economic development tool for local communities to partner with the State of Texas to promote job creation and significant private investment that will assist economically distressed areas of the state. - Product Development and Small Business Incubator Fund

The Product Development and Small Business Incubator Fund (PDSBI) is a revolving loan program financed through original bond issuances. The primary objective of the program is to aid in the development, production and commercialization of new or improved products and to foster and stimulate small business in the State of Texas. - Skills Development Fund

The Skills Development Fund is an innovative program created to assist Texas public community and technical colleges finance customized job training for their local businesses. The Fund was established by the Legislature in 1995 and is administered by the Texas Workforce Commission. Grants are provided to help companies and labor unions form partnerships with local community colleges and technical schools to provide custom job training. Average training costs is $1,800 per trainee; however, the benefit may vary depending on the proposal. - Self-Sufficiency Fund

The Self-Sufficiency Fund is a job-training program that is specifically designed for individuals that receive Temporary Assistance for Needy Families (TANF). The program links the business community with local educational institutions and is administered by the Texas Workforce Commission. The goal of the Fund is to assist TANF recipients become independent of government financial assistance. The Fund makes grants available to eligible public colleges or to eligible private, nonprofit organizations to provide customized job training and training support services for specific employers. A joint application from the employer and the eligible public college and/or eligible private, nonprofit organization is required to be submitted to the Local Workforce Development Board for review and comment prior to approval.

Texas Department of Agriculture

- Capital for Texas (C4T) – C4T is designed to increase rural communities small businesses’ access to capital and enable private entrepreneurs to make market-driven decisions to grow jobs, assist their growth potential and employment capabilities through partnering community development financial institutions.

- State Trade Expansion Program (STEP) – The program’s objectives are to increase the number of small businesses that are exporting, and to increase the value of exports for those small businesses that are currently exporting. The STEP program will take the necessary steps to create or expand their export capacity and provide financial assistance along the way to help them achieve success.

- Texas Rural Business Fund (TxRBF) – The Texas Rural Business Fund (TxRBF) is a pilot program that provides funding to rural communities and counties to incentivize job creation and industry development in rural Texas. Applicants must demonstrate how the business recruitment or expansion significantly impacts the community and region.

Federal Incentives

The Historically Underutilized Business Zones (HUBZone) program helps small businesses in urban and rural communities gain preferential access to federal procurement opportunities. These preferences go to small businesses that obtain HUBZone certification in part by employing staff who live in a HUBZone. The company must also maintain a “principal office” in one of these specially designated areas. The program’s benefits for HUBZone-certified companies include:

- Competitive and sole source contracting

- 10 percent price evaluation preference in full and open contract competitions as well as subcontracting opportunities

- The federal government has a goal of awarding 3 percent of all dollars for federal prime contracts to HUBZone-certified business concerns.